GBA Workshop in HCMC: Vietnam Tax & Accounting – What’s new in 2026?

- Thursday, 8:30 AM to 10:30 AM

- Deutsches Haus Ho Chi Minh City

- HCMC

Contact event manager

Book your tickets

GBA Workshop in HCMC: Vietnam Tax & Accounting – What’s new in 2026?

HCMC

Thursday, 8:30 AM to 10:30 AM

January 29, 2026

000000

GBA Workshop in HCMC: Vietnam Tax & Accounting – What’s new in 2026?

HCMC

Thursday, 8:30 AM to 10:30 AM

January 29, 2026

Vietnam’s tax and accounting landscape is undergoing one of its most significant regulatory shifts in recent years, bringing new compliance challenges and strategic implications for foreign-invested enterprises (FDIs) and expatriates.

Starting from 2026, businesses operating in Vietnam will be subject to a new accounting regime with higher compliance and reporting requirements, directly impacting tax exposure, payroll structures, accounting systems, and overall business operations. Many companies may not yet be fully aware of how these upcoming changes could affect their current setup.

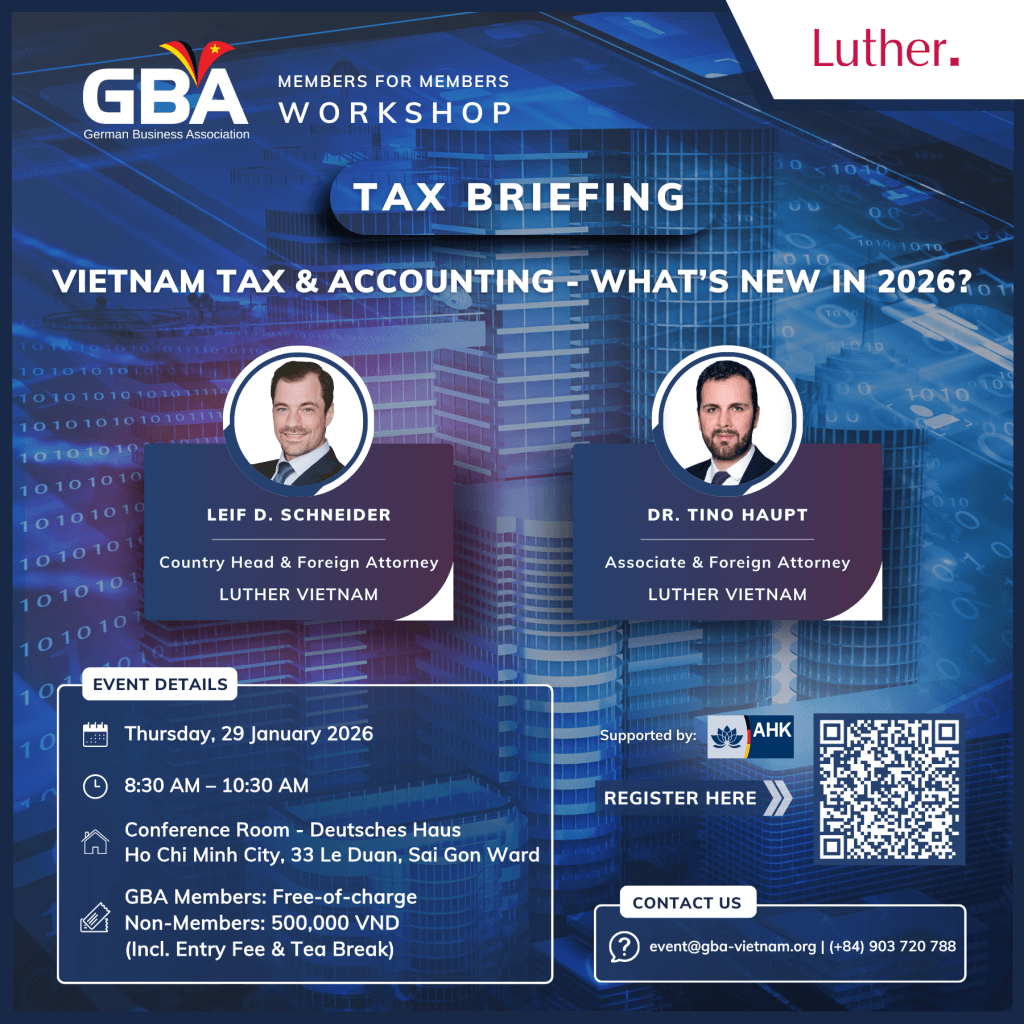

Join us for the GBA Members for Members Workshop, “Tax Breakfast Briefing: “Vietnam Tax & Accounting – What’s New in 2026?”, co-hosted by GBA & Luther Vietnam, supported by AHK Vietnam on Thursday, January 29, in Ho Chi Minh City. This briefing will provide practical insights into the latest regulatory developments and their implications for businesses in Vietnam.

Event Details:

- Date: Thursday, 29 January 2026 | Time: 8:30 AM – 10:30 AM

- Venue: Deutsches Haus Ho Chi Minh City (map)

- Attendance Fee: GBA members: Free | Non-members: 500,000 VND

Speakers/Panelists:

- Mr. Leif D. Schneider – Country Head & Foreign Attorney of Luther Vietnam

- Dr. Tino Haupt – Associate & Foreign Attorney of Luther Vietnam

Who Should Attend: CFOs, Finance Managers, HR Managers, Compliance Officers, Business Owners, and Expatriate Managers operating in Vietnam.

SIGN UP NOW! (Limited number of registrations on a first-come, first-served basis)

For any inquiries, please contact us at email or tel: (+84) 903 720 788 (Ms. Mai Anh)